Tax legislation and the implications for businesses are becoming increasingly complex. Through our tax division, we provide tax advice and other related services and are particularly well placed to act for clients for whom we are also auditors.

The tax residence of a company is determined by the location where the business is controlled and managed and not necessarily where the company is incorporated. In practice, if the directors of a company hold their board meetings and exercise control in Singapore, then the tax residence of that company will be in Singapore. Conversely, a company is a non-resident when the control and management of the company is not exercised in Singapore.

From YA2020 onwards , newly incorporated companies enjoy 75% tax exemption of the first S$100,000 of normal chargeable income, followed by a further 50% tax exemption on the next S$100,000.

A person making payments of a specified nature to a non-resident of Singapore should withhold a percentage of the payment and pay the amount withheld to IRAS. This is termed as ‘Withholding Tax’.

Withholding tax is applicable to the some of the following nature of transactions: Interest (15%), Royalties (10%), Company director’s remuneration (22%), Technical assistance and service fees (17%), Management fees (17%). For more assistance on withholding tax, please contact us.

From 1 July 2016, the withholding tax form should be submitted electronically via IRAS’ myTax Portal by the 15th of the second month from the date of payment to the non-resident.

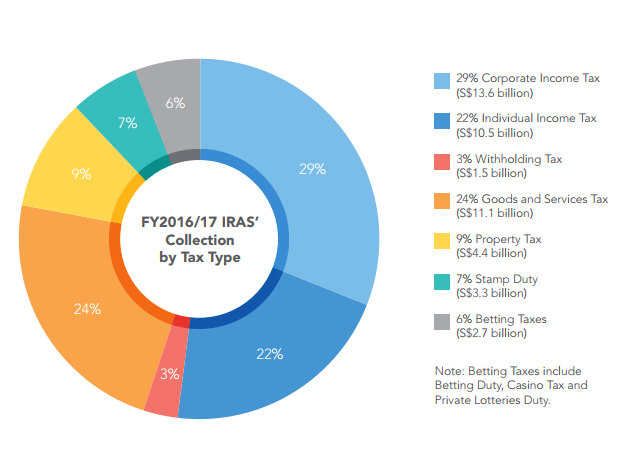

GST is now the second largest contributor to amount of taxes collected by IRAS at S$11.1 billion in FY2016/17 (up from S$10.3 billion in FY2015/16). As a steadily growing source of revenue, it is imperative businesses ensure they have a keen grasp over their GST affairs.

Source: IRAS Annual Report 2016/17

Broadly, you are liable for GST registration if the value of your taxable turnover at the end of the calendar quarter is more than S$1 million or if you can reasonably expect your taxable turnover in the next 12 months to be more than S$1 million.

However, even if you are not liable to be GST registered on a compulsory basis, you may still register to register for GST on a voluntary basis, subject to certain conditions.

Otherwise, there may also be avenues for companies to be exempted from GST registration such as if you make more than 90% zero-rated supplies.

We can advise you on the whether your company is liable to be GST registered as well as the implications or benefits from being GST registered.

Generally, all supplies of goods and services made in Singapore are subject to GST at the prevailing rate of 7% unless they qualify for zero-rating under the GST Act. The applicability for zero-rating on goods depends on whether there is an exportation of goods from Singapore to a place outside Singapore and whether you have maintained sufficient export documentation as evidence that the said goods have been exported.

For services, you need to determine the nature of the services and whether they qualify as international services under Section 21(3) of the GST Act. There are a total of 25 provisions under Section 21(3) and the different conditions for each one might make it difficult to determine whether the services provided can qualify for zero-rating.

We can advise you on your company’s specific business transactions and determine whether they can qualify for zero-rating.

Contact us for more details. We would love to hear from you! Get in touch with one of our professional consultants now using the online form below or calling +65 6224 1076.